PSYOP-MARKET-CRASH: The AI-BUBBLE And The Deepening Recession

🚨 THE BLACK FRIDAY SALE CONTINUES! 🚨

America is currently in a recession, and the stock “market” is now more overvalued than at any other time in history…

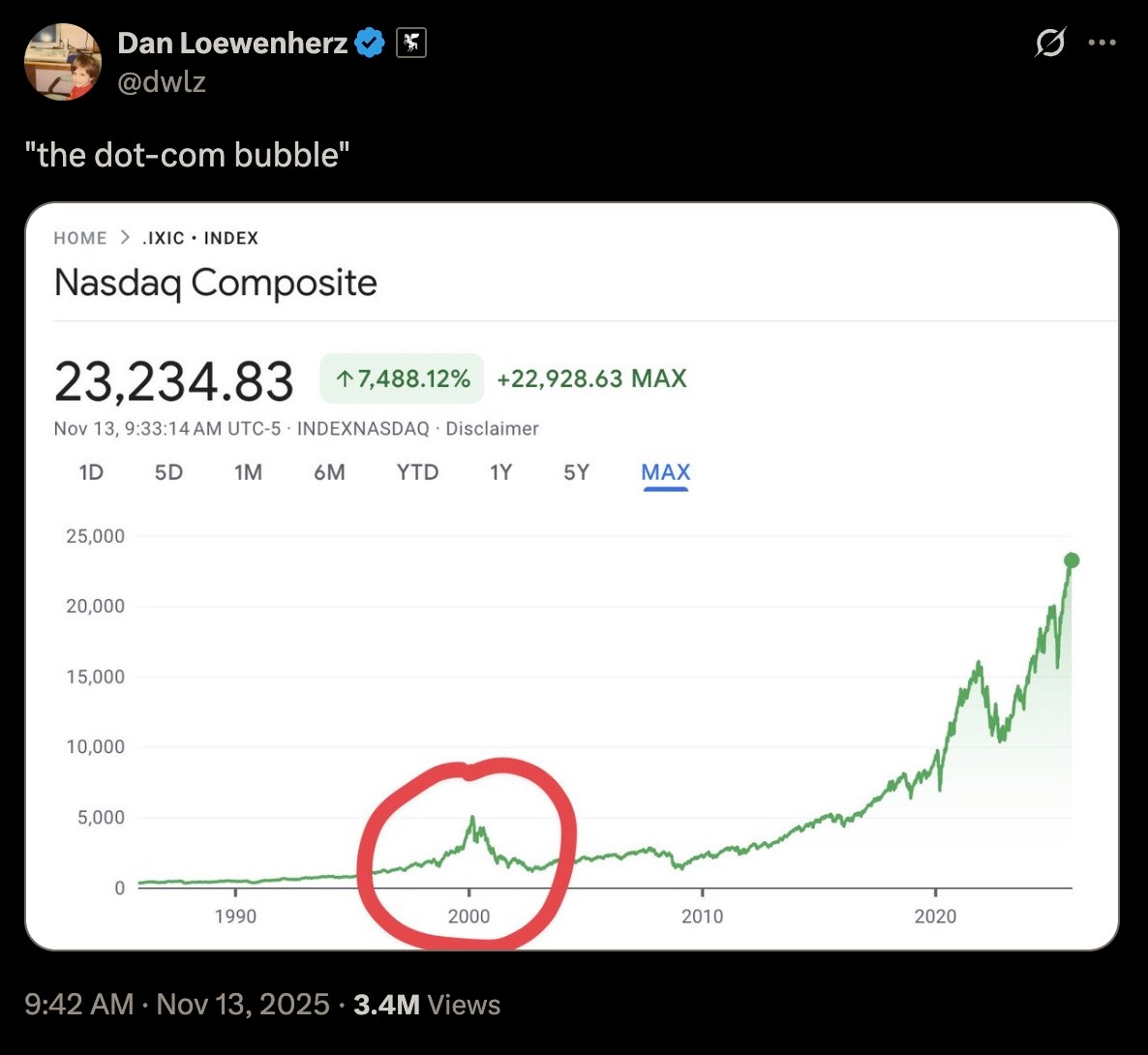

…driving this untenable bubble is the AI sector, which is making all previous bubbles look exceedingly tame by comparison, with all kinds of fraudulent accounting and fake valuations fueling this disastrous financial engineering.

It is important to appreciate that much of this stock “market” hyperinflation is due to the Federal Reserve Bank, which used the PSYOP-19 scamdemic as the ultimate cover to profligately print mind boggling sums of fiat out of thin air, with the Fed’s balance sheet expanding from approximately $4 trillion in 2020 to nearly $9 trillion by 2022, effectively doubling in size.

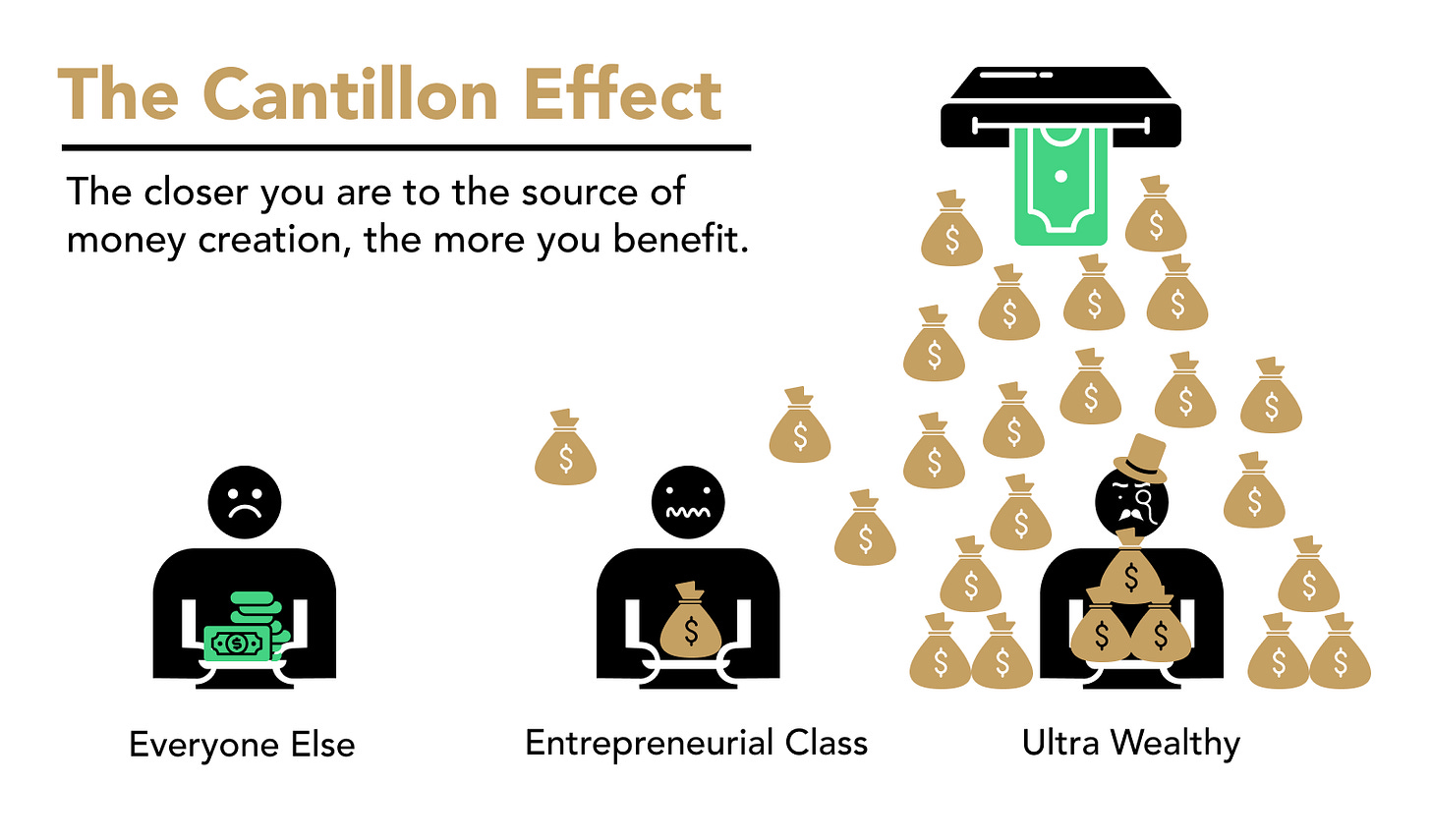

This is referred to as the Cantillon Effect, whereby those closest to the money printer benefit the most; to wit:

And those that benefitted the most from said conjuring of fiat have all piled into AI related stocks, which have in turn blown this bubble to unprecedented nosebleed levels.

Except that under the proverbial hood the AI sector is a badly manipulated hot mess of fraud, with no real underlying profits to speak of.

For example, OpenAI’s ChatGPT is totally unprofitable, despite “generating” substantial revenue, with the company losing significantly more than it earns. In the first half of 2025, OpenAI reported $4.3 billion in revenue, but a net loss of $13.5 billion, representing a staggering financial deficit.

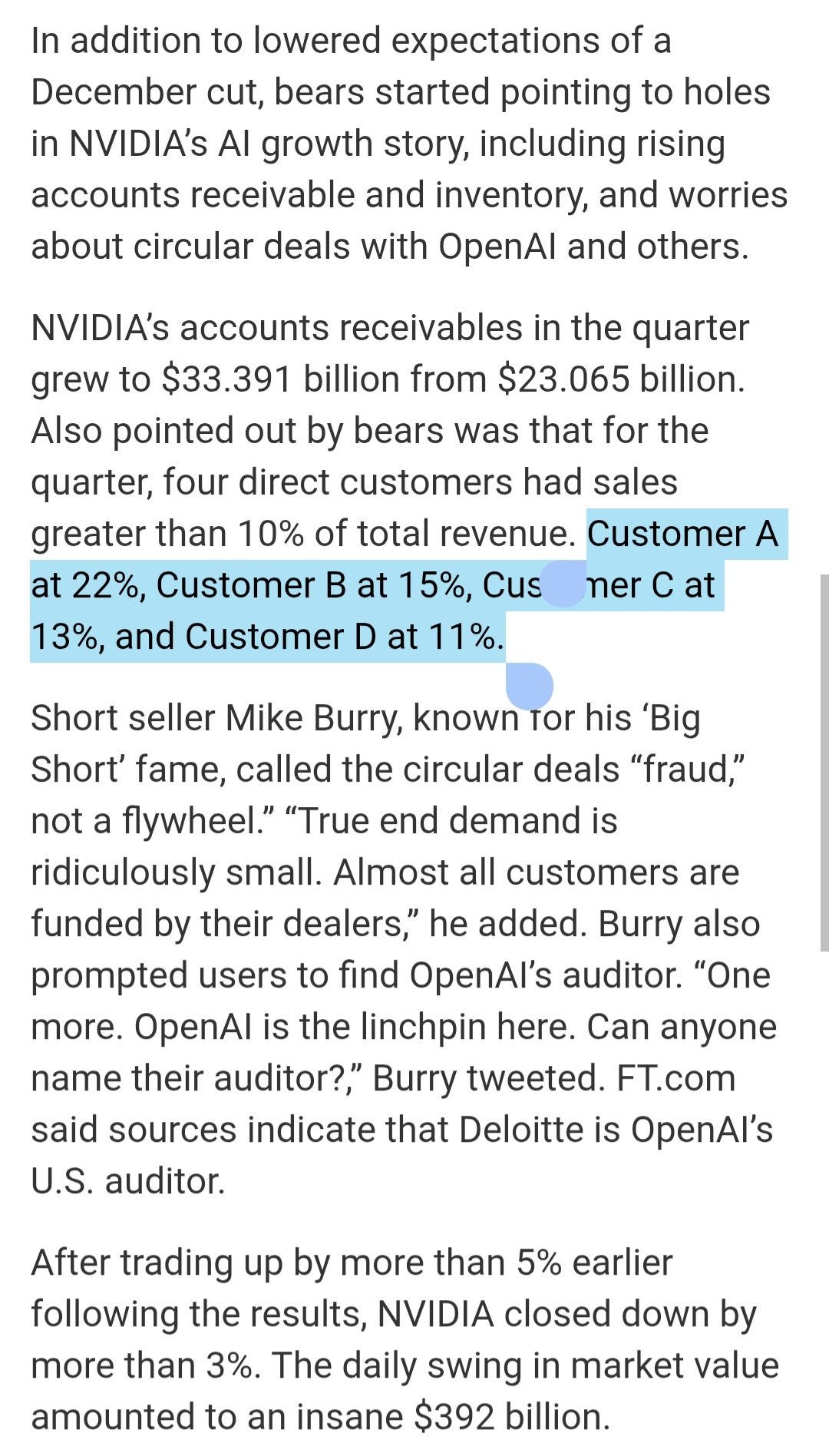

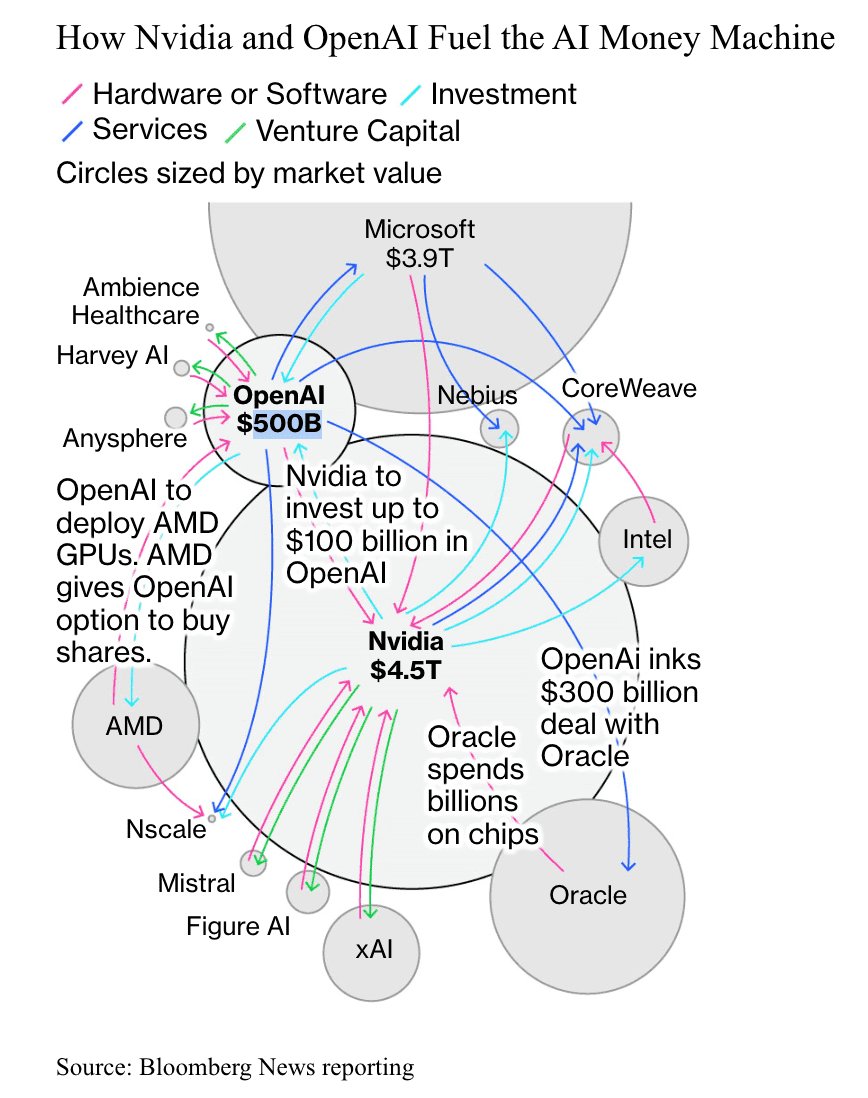

But the poster child for this AI-BUBBLE is the chipmaker Nvidia, which is literally showing profits due to an egregious tech sector scheme that would make Charles Ponzi blush; to wit:

Just 4 customers make up 61% of the revenue of Nvidia, the world’s most valuable company. That’s crazy.

Those customers weren’t identified, but they’re obviously Big Tech corporations involved in a circular financing scheme.

A growing share of those purchases are done on credit

Basically, Nvidia’s valuation and stock price are a direct function of credit, or debt, and this is how we find ourselves in the greatest bubble in the history of markets, making the Great Financial Crisis of 2008 look like utter child’s play:

Let me explain how companies are hiding hundreds of billions in debt using accounting structures that are technically legal but recreate the opacity that triggered past financial crises. Meta has $30 billion in special purpose vehicles for data centers that don’t show up as debt on their balance sheet. Oracle committed $300 billion to OpenAI, but structures it as “capacity commitments” rather than traditional debt. Insurance companies hold over 35% of their assets in private credit that gets rated by firms paid by the borrowers themselves.

How It Works

Special purpose vehicles let companies say “we’re not borrowing directly, we’re just committed to paying rent on these data centers for five years.” So instead of showing $30 billion in debt, it appears as an operating lease commitment buried in footnotes. Oracle’s $300 billion deal with OpenAI gets structured as “revenue sharing agreements” that don’t hit the balance sheet all at once. Insurance companies classify private loans as “investments” and value them using ratings from firms that borrowers pay, letting them look safer than they are. NAV loans use private equity fund investments as collateral, valued at the PE firm’s own estimates rather than market prices since they don’t trade daily like stocks.

My Take

This is Enron and 2008 mortgage-backed securities repackaged for the AI era. The accounting follows current rules, but the rules let companies move massive risk to places investors can’t easily see. Morgan Stanley estimates tech firms will need $800 billion from private credit in off-balance sheet deals by 2028. When Meta keeps $30 billion off its balance sheet while UBS warns about $100 billion in quarterly AI debt buildup, you’re watching leverage accumulate outside traditional visibility. The real danger is when these “operating commitments” and “capacity agreements” all come due simultaneously during a downturn. Insurance companies have bet policyholders’ money on loans rated by people paid by borrowers. Private equity firms are using NAV loans backed by investments they can’t sell from the zero-rate era. It’s all interconnected, and nobody knows where all the exposure sits until something breaks and forces it into the open.

Hedgie 🤗

These data centers that do not show up as balance sheet debt are already driving energy prices up, which will further squeeze Main Street during the upcoming followup global financial crisis. Or why Bill Gates recently made a complete u-turn on PSYOP-CLIMATE-CHANGE, and now claims that anthropogenic CO2 emissions are no longer such a threat after all, because data centers are vital for AI enslavement.

Additional context:

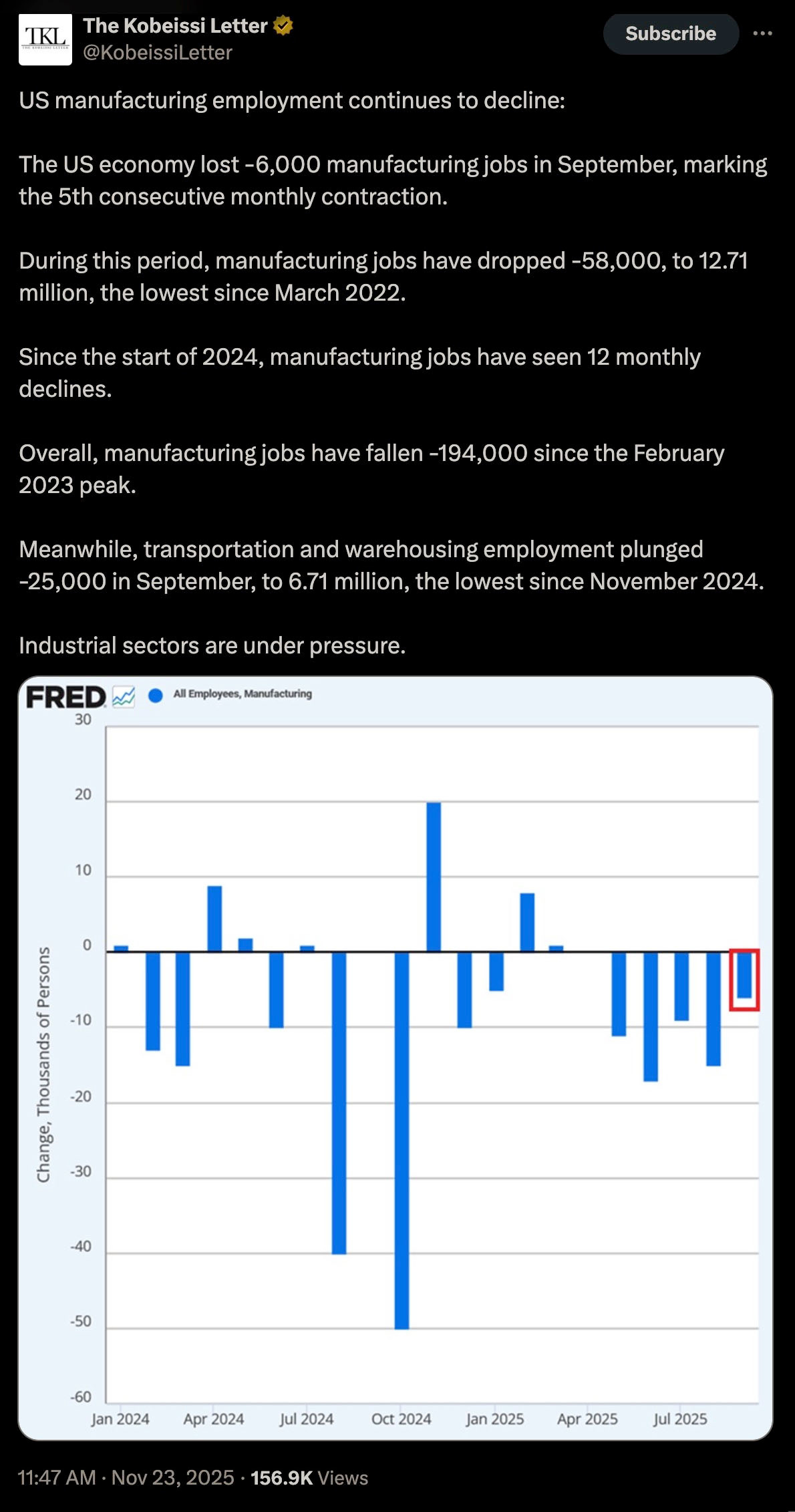

How about that job market?:

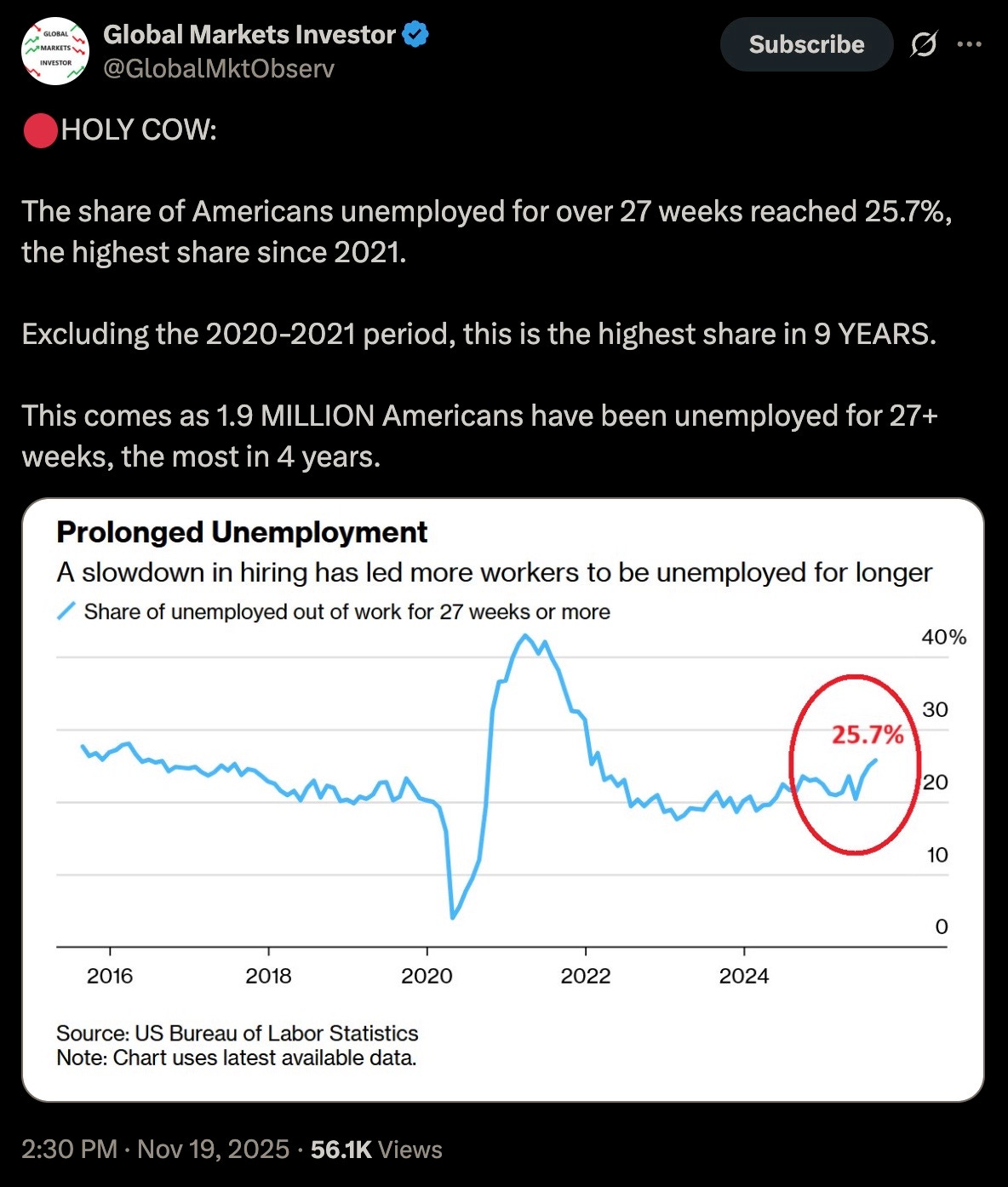

Holy cow indeed:

Back to AI and the government refusing to share 3rd quarter GDP, because things couldn’t be better in MAGA-land:

And just how bad is this AI scam?

Remember, much of this AI spending is nothing more than credit between just four companies, and if any of these quartet of players experiences any additional financial turbulence, then it is game over.

And speaking of turbulence, private credit is now literally locking up:

And in case anyone for whatever reason doubts that we are in the midst of a serious recession:

Of course Bessent, like all other government apparatchiks, can’t help but speak out of both sides of his mouth, adding that, “the U.S. economy should avoid recession.”

Because there are no more business cycles, recessions can be avoided forever, the Fed will simply print away any future economic pain, and the AI-BUBBLE will never ever experience a significant correction; in other words, the gov is unable to stop peddling to their tax-slaves absurdist fantasy narratives.

Except that the Trump administration is acutely aware of just how bad the U.S. economy is, and just how much the average American is suffering; to wit:

Trump better rejigger his economic messaging ASAP, and while he’s at it he needs to end the IRS and the Fed so that We the People can prosper once again:

The AI-BUBBLE is merely yet another symptom to the structural financialization, centralized money printing, and interest rate manipulation, or the repression of true free market capitalism.

This Substack predicts that there will be a major correction sometime in December, which may very well kick off the next global financial crisis.

Do NOT comply.

The BLACK FRIDAY SALE has been extended throughout the month of November, so please take advantage of these low prices and stock up on all of these lifesaving compounds!

Please use code BF20 to receive 20% off on the newest product Hydroxychloroquine, as well as ALL of the amazing products that you have been purchasing for many years now like the Nobel Prize winning miracle compound Ivermectin, the no less miraculous Fenbendazole, Doxycycline, the full spectrum organic CBD oil containing 5,000 milligrams of activated cannabinoids and hemp compounds CBD, CBN & CBG, the powerful immune support nutraceutical and spike support formula VIR-X, and the sugar craving reducing, blood sugar balancing and even anti-cancer allulose sugar substitute FLAV-X!

The FLASH SALE ends Sunday, November 30th (midnight eastern time), 2025.

Upon adding products to your cart, please go to the cart icon at the top right corner of your browser page and click it, then choose the VIEW CART option whereby you will be redirected to a page where you can enter the code BF20 in the Use Coupon Code field.

Only the RESOLVX HEALTH website offers all of the authentic products that this Substack promotes.

Please contact the company directly with any product questions: info@resolvx.health

I do wonder if/when some people will realize that AI is just lines of code, as fallible as the folks who wrote it. Useful tool for some things, absolutely, but "intelligent"? Um, nope. But most excellent at turning a profit for those who could afford to invest bigly. The specter of a shambling AI/mRNA golem coming for us all is a bit unsettling, but oh, the profits! Weird, but my only hope there is that the circle jerk of AI and mRNA fizzles out, even if after the wealthy get the profits generated. But looks like Gates' nuclear reactor investment is really going to pay off, too. For those who wonder where all the electricity is going to come from. Profit bonanza.

Thanks for all this information, and thanks for the access to those "forbidden" medicines.

I hope your are spot on with the December call. It is the only thing that will turn this ship around. We need a thundering crash so that productive 20 year old's can buy a house and have kids. etc.