JUST IN - PSYOP-HYPERINFLATION-22: US inflation surges to 9.1%, the highest in 40 years.

Expect upcoming inflation prints for EU nations to also soar.

Expect PSYOP-FAMINE-22 on a global scale.

by TYLER DURDEN

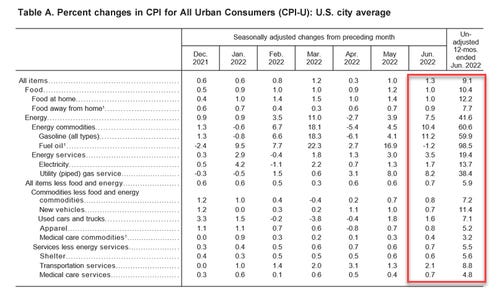

With The White House having desperately tried to front-run this morning's inflation print, analysts were expecting a jump higher led by food and energy costs. They were right in direction but it was way worse as the headline CPI soared 9.1% YoY (vs 8.8% exp and 8.6% prior)...

Source: Bloomberg

The 1.3% MoM rise is the hottest since 2005 and the 9.1% YoY is the hottest since 1981.

Goods inflation is slowing but services costs are soaring at their fastest since 1991...

Source: Bloomberg

Under the hood, energy costs dominated the rise, but the rent index rose 0.8 percent over the month, the largest monthly increase since April 1986.

The motor vehicle maintenance and repair index increased 2.0 percent in June, its largest increase since September 1974.

The index for dental services increased 1.9 percent in June, the largest monthly change ever recorded for that series, which dates to 1995.

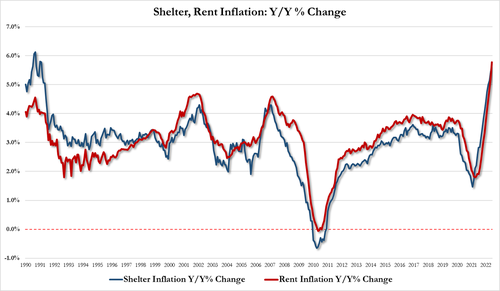

Focusing on the roof over your head factor, shelter inflation +5.61%, up from 5.61%, highest since 1992, and rent inflation +5.78%, up from 5.22%, highest since 1986

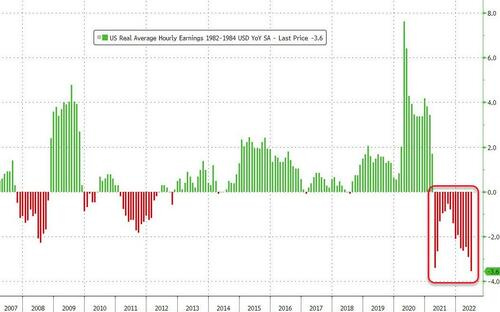

Real wages fell for the 15th month in a row... (Americans' purchasing power domestically fell by a record 3.6% YoY in June)

Developing...

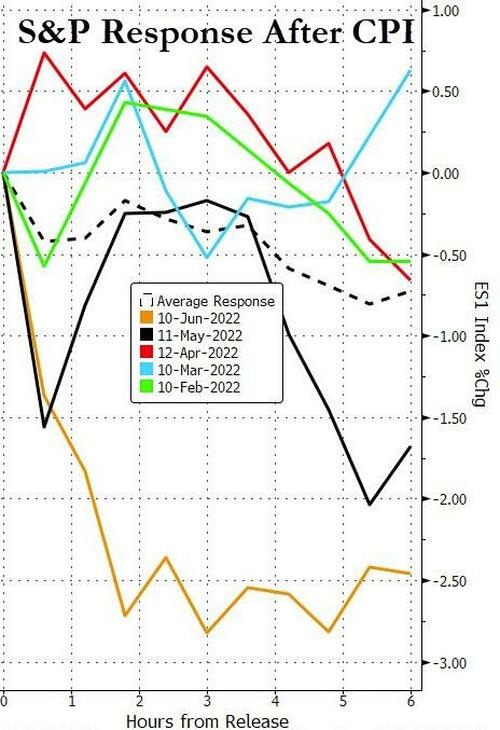

Finally, the S&P has ended the day lower on 5 of the last 6 CPI days...

Trade accordingly.

Do NOT comply.

Who let the dogs out woof woof. Sorry it was my first thought when I saw the headline. The real number is likely double so 20% is my guess.

Guys... this only leads into one direction. Financial reset. Banks will liquidate before 2030. If you have the means (I don’t) pay off your mortgages ASAP. When banks liquidate you no longer own your house.