Degenerate cryptofinance

"Money is the bubble that doesn't have to pop." -> Except that it ALWAYS Does

I have many issues with Curtis Yarvin’s views on modern monarchies which are overall quite facile, but that does not mean that he is incapable of making incisive observations.

Let’s start with his first quote:

"Money is the bubble that doesn't have to pop."

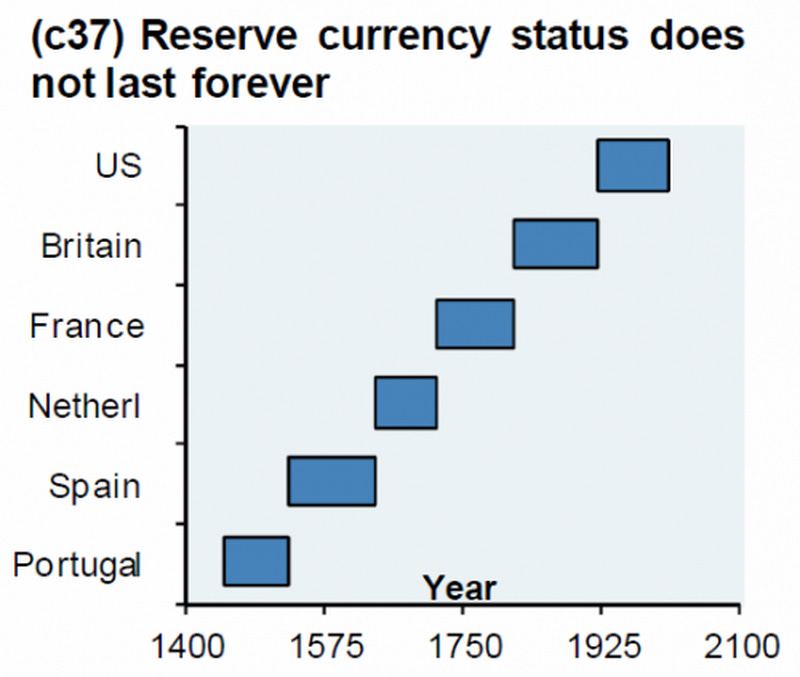

Let’s address this with a simple chart that anyone can appreciate:

If Curtis were referring to the only true money that the human race has ever known that stretches back well over 5 thousand years, then that would be one thing, but as his below article points out, he is certainly not referring to the barbaric relics.

Without dissecting his entire article, which is very much worth reading, let’s just say that he gets much right about this latest centralized “stable” coin crypto fiasco, yet he fails to elaborate on true decentralization and DeFi — I promised many that I would get around to writing about this and will soon — in the meantime:

When I first came up with the line “money is the bubble that doesn’t have to pop”—check the date, by the way—I had a vague surmise that one day it would all come true. Or truer than I could possibly believe. (I am not Satoshi, though I should have been—I had the motive, the opportunity and the propensity.)

Every currency is in a sense a Ponzi—a zero-yield Ponzi. A zero-yield Ponzi does not, like a normal Ponzi, pay a yield as more buyers buy in. But it still shows a false profit. Its supply is limited, so the price of the security goes up as more buyers buy in. But what goes up has to come down—unless it stays up, by becoming the standard medium of saving. Money is the bubble that doesn’t have to pop.

A currency is a repository of savings or “store of value,” overvalued because it has become a standard commodity to shift purchasing power across time. Because the demand to shift purchasing power across time is structurally stable, an economy in which there is only one standard medium of saving is stable—it can price all other goods using that medium as a stable numeraire.

Competing media of saving are unstable. When there is one clear standard, that standard is money—the rest are Ponzis. When there are multiple serious competitors—like gold and silver, or Bitcoin and Ethereum—either they develop a reasonably standard (if arbitrary) equilibrium, or chaos ensues until one is fully demonetized.

The lesson of this incredibly simple Nash equilibrium or Keynesian beauty-contest game is that if you are creating or buying into a new “candidate currency” designed to appreciate solely due to its limited supply, and your currency does not have a serious chance of becoming a stable standard, you are in a Ponzi. Except for the winner, what goes up must come down. But the winner actually can stay up.

A demonetized currency returns to the industrial value of the commodity. In the case of cryptocurrency this is of course zero. We had one of these recently: Terra/Luna.

The narrow lesson: a suicide Ponzi

Luna was a Ponzi with a suicide vest. The suicide vest was called Terra. Terra (UST) was supposed to trade always at a dollar. This was accomplished by a contract that let anyone exchange $1 of UST for $1 of LUNA. Demand for Terra was created by paying 20% interest rates—classic Ponzi levels.

The way to think of a classic candidate currency is as a pressure tank. Buying into the tank pumps money into it and drives its price up. Selling is the reverse. If the tank’s volume expands or it even springs a leak, the price of the cryptocurrency goes down.

Because Bitcoin is mined, it is slightly less optimal than a currency with a fixed supply (or at least a fixed float). Some kind of quasi-magical cryptographic break might let anyone create Bitcoin ad libitum, resulting in a highly suboptimal currency—as if the tank had sprung a leak.

Luna was a Ponzi with a leak. The leak was called Terra. There were like $15 billion UST. All of these tried to squeeze out through the leak.

If a stablecoin is trading for $1, no one has an incentive to escape it. Once it trades for slightly less, anyone who can get one for 99 cents and redeem it for a dollar can make a profit. The Terra contracts let anyone burn $1 in nominal Terra to create $1 worth of new Luna—which could then be sold for $1 in dollars.

Once the UST/USD market traded under $1, there was an incentive to withdraw Terra by moving it into Luna and selling that Luna. From Luna’s perspective, everyone who had Terra held a license to counterfeit.

Luna was a Ponzi with an exit. The exit was called Terra. The problem with UST was that, as in most Ponzis, once anyone ran for the exit, everyone had to run for the exit.

As more Luna was created and sold, its price dropped—which let each UST holder create and sell more LUNA. This was the death spiral. Meanwhile, despite the fact that anyone paying 90 cents for a UST could earn a dollar, only $100M of UST could be redeemed this way every day.

But since UST was imploding, many people wanted to sell it—even for less than a dollar. This created a pileup around the UST/USD exit that kept UST under a dollar. So long as LUNA had any value at all, the UST/LUNA exit stayed open—and flowed freely under the $100M/day restriction.

You might think that if it could only leak out at 100M/day, a currency with a market cap of $18 billion should be able to hold out 180 days. Sadly, this is not how supply and demand works. As LUNA fell, converting $1 of nominal UST into LUNA created more and more nominal LUNA, all of which was sold into the market.

The ginormous hyperdilution created by the death spiral overwhelmed any effort to buy up or otherwise defend the currency. The Luna Foundation had like $2B in bitcoin. It is not known what happened to this hoard. If it was spent on buying back Luna, how could it have held back the mathematical avalanche for more than minutes?

The broader lesson: find the users

Issues in this space are certainly not limited to Terra.

For instance, credible friends of mine suspect that the backing of Tether, the leading stablecoin and one much more important and reputable, includes a chain of funky related-party securities at the end of which is found—crypto. Thus, as in Terra/Luna, issuance of the fixed-value security buys up the store of value.

If Tether really holds bitcoin or some other collateral whose price it is big enough to move, it can melt down in a classic bank run, in which the need to sell the collateral impairs the market price of the collateral, as it fire-sells this reserve. I hope it isn’t so (and it would certainly not surprise me if it wasn’t so), but people with nothing to hide don’t usually act like people with something to hide. Just saying.

Having experienced a number of “industry” bubbles, there is one sure way to tell a business from a bubble: find the users. If humans are using the product in a way that they find valuable, money can be extracted from them. The business can live. If not…

Cryptocurrency is a thing. Cryptocurrency is not about finance or even payments—cryptocurrency is about restandardizing the global medium of saving. Payments, especially private payments, make this easier (it is a big strategic own-goal for the leading medium of saving to still not be a privacy coin) but are not even required. If the empire of paper can be unseated—there is a lot of dollar debt, and hence dollar demand—Bitcoin is probably the winner but Ethereum may have a chance. Finance—

Cryptofinance is not a thing. Here is why: there are no users. Oh, there are certainly lenders. But there are no true borrowers—only those who borrow in order to lend again. People who borrow to lend are financiers, not borrowers.

The true borrower spends current money to create or acquire a capital asset—like a house or a factory—that produces a stream of returns. The house produces housing, which is sold (think of it as a rental); the factory produces widgets, which are sold. For the borrower to profit, the yield on the capital spending must exceed the interest rate.

One could argue that Bitcoin mines, which require a capital investment and produce a predictable stream of income, should be financed in Bitcoin—taking present Bitcoin and returning future Bitcoin. Well—they could be.

Or they could be financed in dollars, and produce Bitcoin/dollar futures. Their capital expenses are most certainly in dollars. Your investment pays for these expenses, so why should you invest in terms of Bitcoin? You could—but do most people? Also, Bitcoin loans have to be peer-to-peer, whereas dollar loans are effectively state-subsidized.

Beyond this exception that proves the rule, not only are there no cryptoborrowers—there shouldn’t even be any true cryptoborrowers. And there aren’t. There sure are a lot of ponzis, though.

Again: a ponzi is any cryptocurrency without a realistic chance of becoming the new monetary standard. Any commodity whose price is inflated by its scarcity, but which cannot become money, is a bubble that has to pop. Or gradually deflate—look at the price of Litecoin in Bitcoin over its lifetime. Friends don’t let friends buy Litecoin.

As a friend writes: “crypto became a ‘space’ and now a fake ‘industry’ instead of a currency.” To me, today, the only thing that matters on the blockchain are (a) utility tokens (including rights tokens like the classic NFT) and (b) the race to become the digital future’s standard store of value.

Because only a system with only one monetary standard is stable, there can be only one true winner of this race. (It is unfortunate, from a crypto-anarchist perspective, that the leader is not a computing coin. Or a privacy coin—I expect to see mandatory bitcoin blacklists and chain analysis soon. Is it too late in the day to refit BTC itself with ZK-SNARKs? Power will find its way into any pressure point you give it.)

I still think the blockchain has more future uses than these. But not present uses. Uses that seem to be uses but are not uses—for example, because they have no real users—are fake uses. Sometimes fake things seem to be good for business. They are very rarely actually good for business.

What happens with fake things is that they work based on everyone’s confidence in them. But everyone’s confidence is fragile, because it is gotten from everyone else. When the falsehood is revealed, collective confidence collapses

Bitcoin maximalism—really anycoin maximalism, as the theory allows any coin to come from behind, and the reality seems to be that Ethereum or even an emerging computational chain may have a chance—is the right theory of why scarcity coins have nonzero prices, since it is the only theory that is actually true. The nontrivial financial existence of many seemingly nonviable candidate moneys is a testament to the fact that it is not the only theory that is actually believed.

It may be that for the correct monetary-equilibrium theory to triumph in the market, the market will have to not only select a clear winner, but financially destroy all its competitors. And not even the winner will remain untouched by all these winters.

The lesson here for cryptobelievers is that only a hodler is a hodler. If your coin is not yours—if you have hypothecated it as any kind of collateral for any kind of loan—if you have any kind of leverage—any sufficiently strong winter will own you. You will be cleaned like a toilet and your coin will be sold—making everyone’s winter colder.

Unless you are a clean long, you are not a hodler. You are not part of the revolution. You are part of the problem—because you amplify these cycles, which diminish the credibility and thus the potential of crypto.

Do NOT comply.

Regardless of whether crypto is the future of money- assuming there even is a future- the fact that so many crypto currencies exist was a huge red flag that it's for now a Ponzi scheme. Some claim bitcoin was created by the CIA to test out Central Bank Digital Currency and to divert younger people from precious metals.

I really really wish I understood this article.